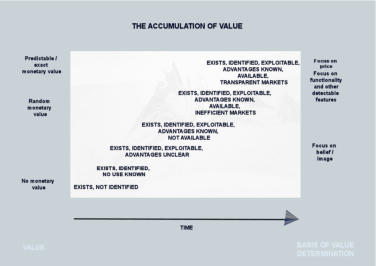

Accumulation of Value

Value of an asset is often equated with a price of a physical item or to something that can be

sensed or recognized via a physical item. Types of values are many; value that one

experiences can differ from the value discussed at the time of transaction. Values shown in

balance sheet have their determination rules. This writing focuses on discussing the

accumulation of value and the concept of value in general, thus cannot be used as guideline

for any accounting practices.

The accumulation of lifetime value of an asset and the price we are willing to pay for an

asset is determined by different factors. An asset in this writing refers to anything provides or

has potential to provide benefit e.g. a learning, a possibility to invent, technology, or a

collectable item. For example, knowledge needed for an invention may exist long before the

invention is made, though the invention may only be made when the knowledge recognized

and used for the invention.

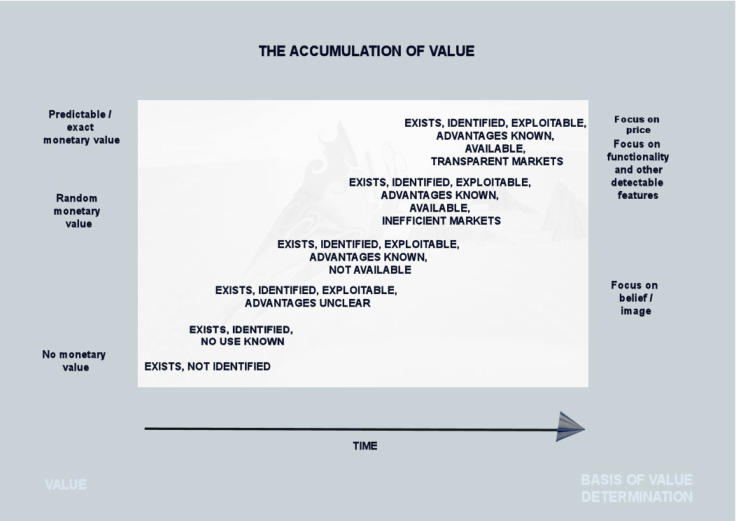

The picture below is an illustration/ example of the accumulation of a value. The ability to

define the asset under examination is important. When information is rare and the asset is in

format that is difficult to identify, also the valuation of the asset is problematic. Consequently,

the price one pays for the asset at one time is rather randomly determined. The value

accumulates in the value chain through different activities that add to predictability, to the

exactness of valuation and to the value of an asset throughout its lifetime.

Global value chains can give indication of activities that create most of the value. When it

comes to a monetary value accumulation of a specific asset, some phases where the

monetary value is difficult to determine (e.g. research and education) can easily leave

unidentified in the total value accumulation, though the value may be included in other

activities instead.

The accumulation of value is asset specific to some extent; for example, the value

accumulation of assets that include high technology solutions differ from the value

accumulation of assets in case of which the attractiveness bases largely on rarity. Not all

assets accumulate up to highest level, or at least climbing can take a lot of time. Often,

technological development has effect to the value of most types of assets, e.g. through

artificial creation of substitutes, which creates competition and opportunities to make a sales

article a commodity that is widely available and consistent in its features.

Factors contributing to the value include, inter alia, information availability, knowledge and

capabilities. These factors refer not only to the asset itself and to the provider of the asset,

but also to the business environment, in which the value is created. It takes an effort from

the customer also to understand the benefits of a sales article and to determine the price he

or she is willing to pay. From another perspective, supply- demand conditions, competitional

factors, as well as other factors that originate from operating environment shape the value.

Value accumulation is all about information, knowledge and capabilities. How do you think

automation will influence the prices paid for different products and services? What do you

think about this model?

18.10.2018

Johanna Sandman

© Johanna Sandman 2013-2023